The FIA Northwich Practical Launch Event is taking place next Thursday 26th September and Everlux are extremely pleased to be participating as a sponsor as well as exhibiting!

We consider this to be a fantastic opportunity for us to support this FIA initiative and to once again meet with many of our peers from the UK Fire Safety sector. We shall be showcasing our extensive range photoluminescent safety signage and support services with a particular emphasis on Wayfinding signage and our new site services including surveys, installation and plan projects.

Our UK Sales Manager Mark Bridgens will be on hand to and answer any questions you may have and to introduce Simon Mustoe who will have responsibility for the provision of our site services.

If you wish to be part of this unique FIA event you can register your attendance for free via the link provided HERE.

We sincerely hope that we will see you next Thursday!

Everlux is coming to Intersec Saudi Arabia!!!

For the first time, Everlux will be exhibiting at Intersec Saudi Arabia, from the 1st to the 3rd of October, at the Riyadh International Convention Centre.

TheEverlux standis located atHall 5 – n. º A31and the team is looking forward to welcoming all elite specialists in the fire, safety and protection sectors and introducing them to the world of photoluminescent safety signage!

Our products and services, catalogue and latest news will be the highlight of our brand-new stand!

If you are interested in:

- SWGS – Safety Way Guidance System

- Egress Path Marking System UL 1994 Listed

- Aluminium photoluminescent safety signs for tunnels

- Excellence by Everlux

And many more topics related to safety and fire protection, then come and visit our stand for a personalized tour to understand how Everlux products and services can help in your next project!

Register for free here: https://tinyurl.com/Intersec-Saudi-Arabia

We look forward to your visit –stand 5-A31!

We divide safety signage for the digital age into 3 groups:

- Working with digital platforms - Many jobs based on digital platforms are currently carried out in informal and mobile workplaces, where monitoring by occupational health and safety services is difficult.

To be displayed in the social areas of the company, next to the workers, in their vehicles or in the compartments where goods are transported.

This type of signage can be used in the social areas of companies working with digital platforms, in the transportion of goods and passengers, and in the collection of goods:300x300mm

Communication of the risks and the actions required to reduce the level of risk will be more effective if it is accessible to operators as they work:

100x100mm

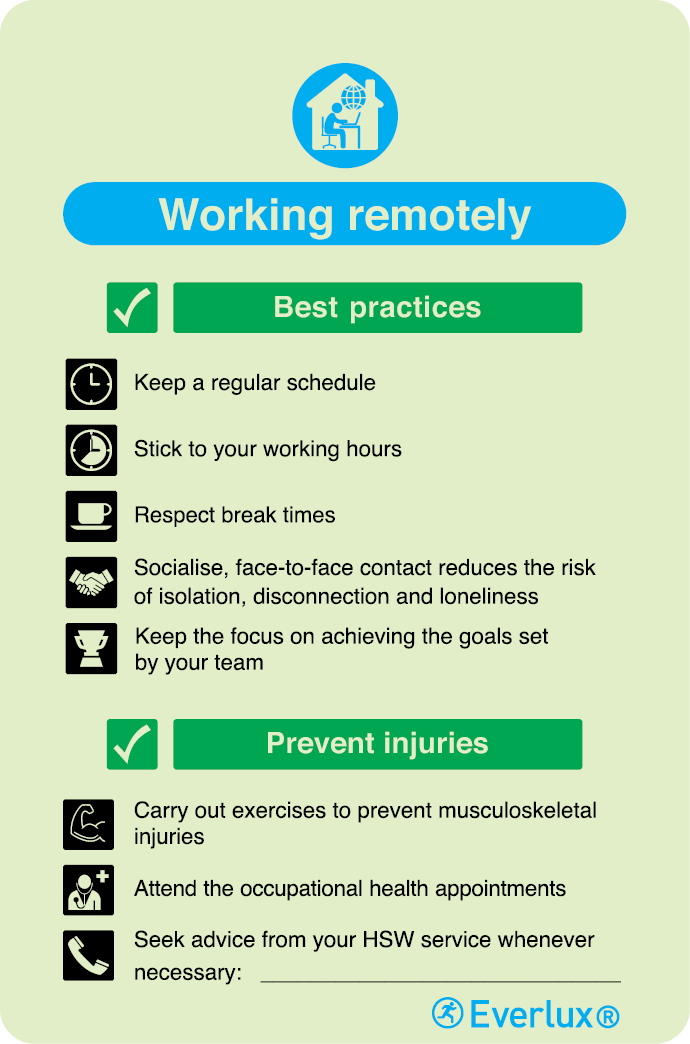

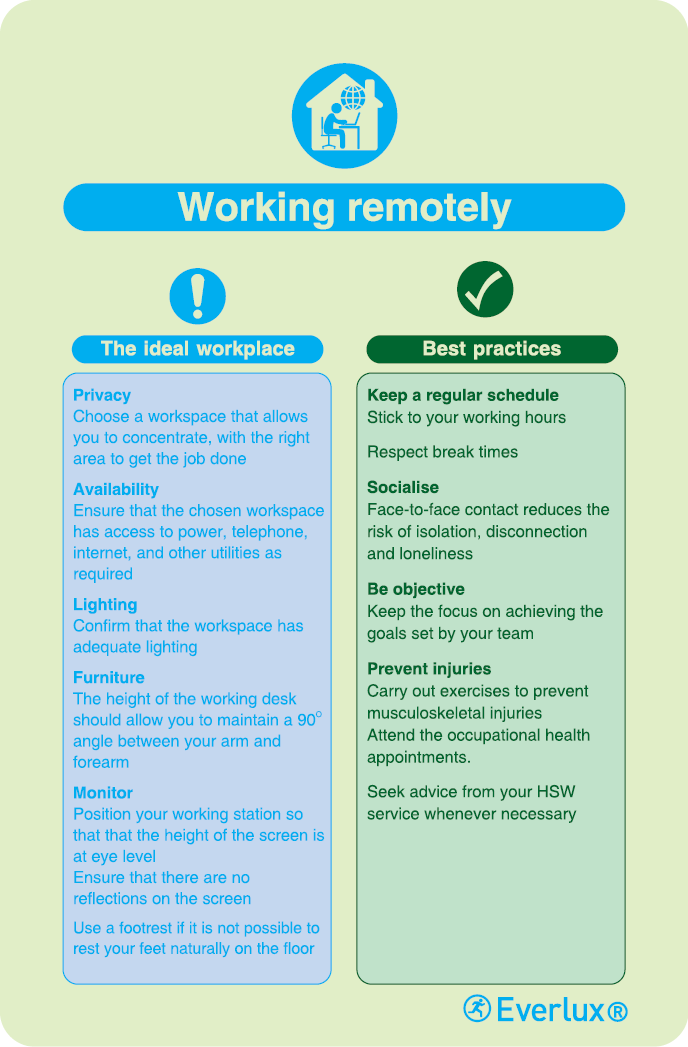

- Remote working - Remote working, with or without digital platforms, is also a challenge for HSW services. Having an ergonomically appropriate workstation and adopting good task management practices, often without the possibility of direct advice from HSW departments, can lead to increased risks and injuries.

Everlux signage for remote workstations, as well as communication of good practice and control measures to be adopted, reinforces the importance of maintaining contact with HSW services. Workstation signage, customisable with company logo and HSW contact details.

100x200mm

100x200m

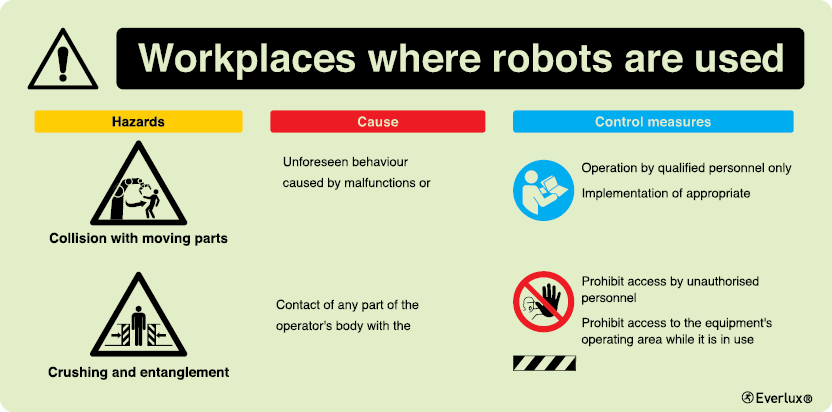

- Working with robots and other digital tools - Businesses are becoming increasingly automated and the use of robots has been a reality in many sectors for some time. It is important that where robots are used in the workplace, the risks are identified, and the necessary control measures are put in place.

300x150mm

We believe that these products add value to companies and to their workers who are the ones who benefit from them.

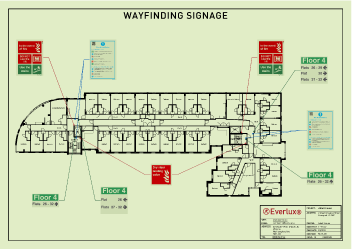

The Everlux team can quickly develop the necessary Wayfinding and Fire Safety Signage Plans required for your buildings.

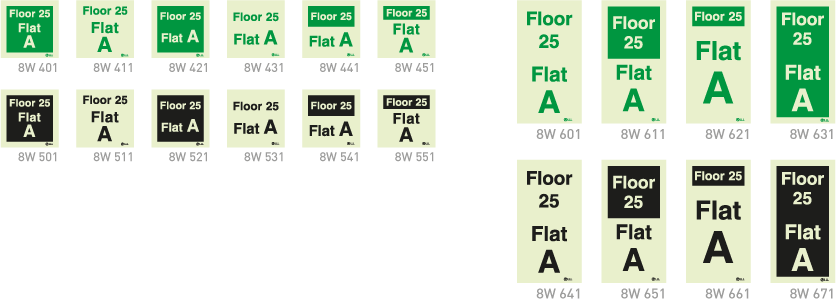

BESPOKE WAYFINDING SIGNAGE

The Everlux bespoke wayfinding signage range allows complete flexibility for the key elements of each individual sign including:

·Storey/Floor Detail

·Flat/Accommodation Detail

·Direction of Arrows

·Building Name

·Stakeholder Logo (requires file copy of logo JPG, PNG, Vector or similar)

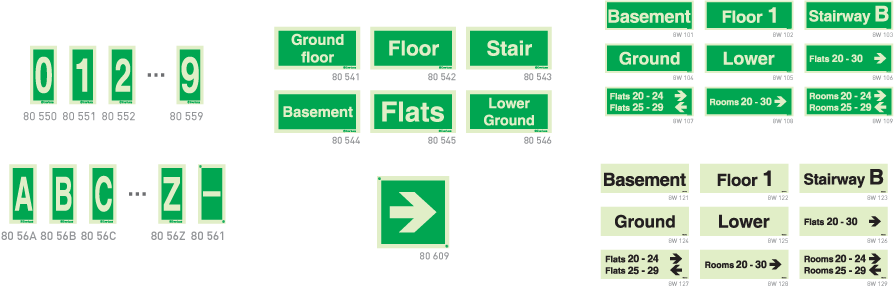

MODULAR WAYFINDING SIGNAGE

The wayfinding signage can also be installed as a modular system comprising all the prescribed elements positioned as shown in the illustration on the right.

Storey/Floor Detail

Flat/Accommodation Detail

Direction of Arrows

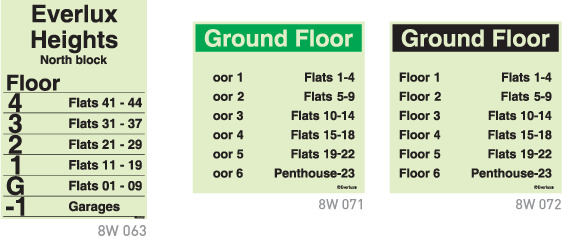

FLOOR/STOREY DIRECTORY SIGNAGE

Additional directory signage indicating all building Storey/Floor details can also be supplied to supplement mandatory Wayfinding signage. These signs are bespoke and can include any specified details or layout as required.

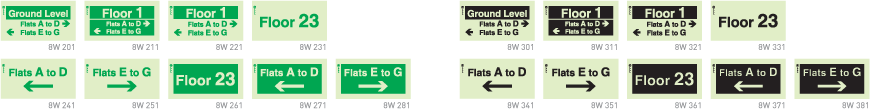

LOW LOCATION LIGHTING (LLL) FLAT/DWELLING INDICATORS

The benefits of having wayfinding indicators positioned at the Low Location Level (<300mm from floor level) are undisputed, especially in corridors and stairwells that are subject to the effects of smoke distribution and accumulation.

Signage to indicate floor levels in stairwells and lift lobbies in high rise premises, to assist the emergency services.

The flat/dwelling indicators are to be placed at low level to increase visibility in smoke conditions.

SIGNAGE FOR ESCAPE WINDOWS & LADDERS

In certain circumstances the provision of escape windows in dwellings is a mandatory requirement as prescribed by the Building Regulations 2024: Approved Document B - Volume 1: Dwellings.

|  |  |

|

|

|

(Colocar esta tabela como está no vídeo)

If you would like to know which buildings in the UK already have Everlux Wayfinding Signage across the UK or more specific information about this range of signage, please contact us.

This is FIA first event in the Republic of Ireland and we couldn’t be more excited to be a part of it and to have the chance to showcase our extensive range of photoluminescent safety signage.

Once there, you will have the opportunity to network with fire industry professionals, from both the Republic of Ireland and from Northern Ireland and our team will be looking forward to meeting you – pitch number 13!

We hope to meet some new potential partners, as well as strengthen the relationships with others who are already familiar with Everlux products and services.

If you are curious about Everlux high-quality photoluminescent safety signage, we offer:

• Evacuation Plans in Accordance with S.I. NO. 137/2019 – Housing (Standards for Rented Houses) regulations 2019;

• Excellence by Everlux – our signage for luxurious and prestigious environments;

• LLL – Low Location Level signage.

The FIA Fire Safety Summit Dublin includes the exhibition (which takes place in the Liffey B Hall) with top key suppliers, but also a full day of CPD accredited conference with very well-known specialists from the fire industry!

Don’t miss this opportunity to know more about the Everlux world and how we can help with your next project!